The 52-week highs reached by Cochin Shipyard, Garden Reach Shipbuilders & Engineers, and Mazagon Dock Shipbuilders in July 2024 have all dropped by as much as 51%.

Concerns over growth caused shipbuilding businesses’ shares to drop as much as 10% on the BSE during intraday trading on Tuesday.

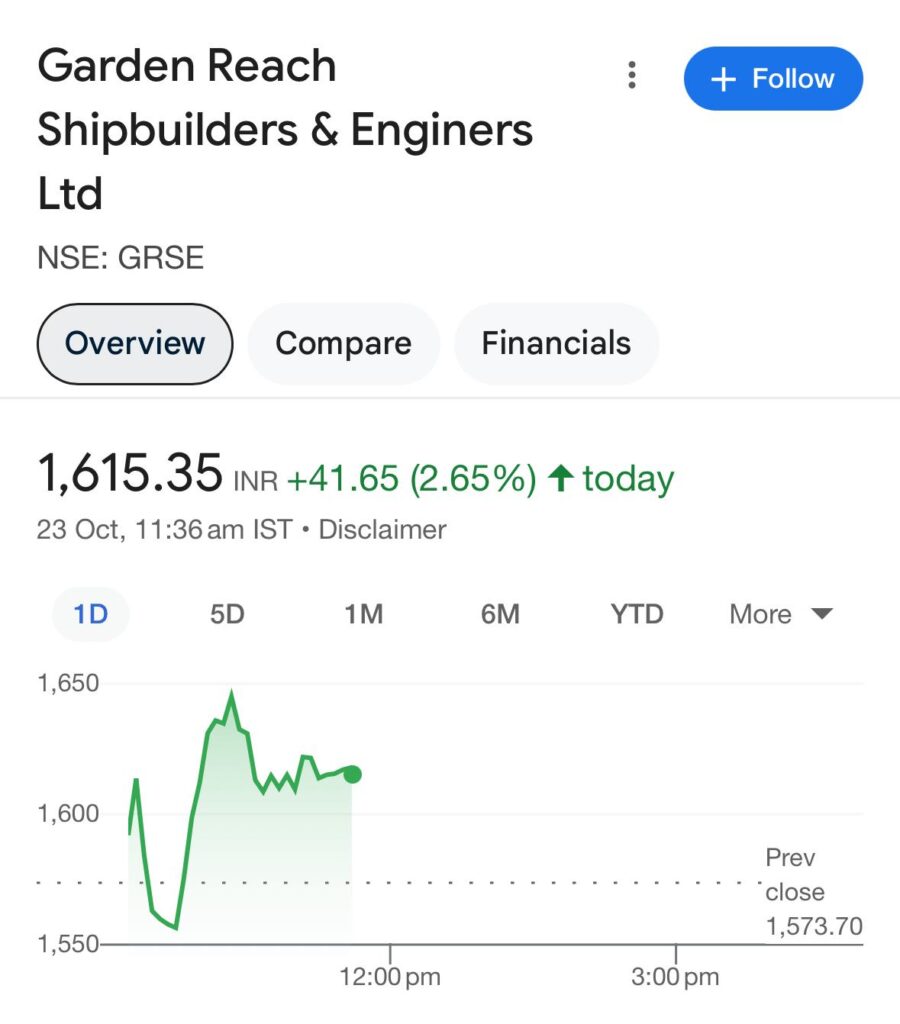

Cochin Shipyard (CSL) remained held at the 5% lower circuit at Rs 1,453.80, Garden Reach Shipbuilders & Engineers (GRSE) fell 9% to Rs 1,643, and Mazagon Dock Shipbuilders (MDL) fell 10% to Rs 4,206.55. By contrast, at 02:14 pm, the BSE Sensex was down 0.53% at 80,717.

From their respective 52-week highs reached in July 2024, these three stocks—CSL (51 percent), GRSE (42 percent), and MDL—have corrected by up to 51 percent.

On the BSE, CSL was trapped at a 5% lower circuit among individual stocks. The government sold 13 million shares, or 5% of the company, in CSL last week through an offer for sale (OFS). The exchequer was expected to receive around Rs 2,000 crore from the sale of shares.

According to CSL’s FY24 annual report, which was released on September 7, 2024, Fitch Ratings kept its pessimistic outlook for the shipping industry’s earnings, mostly because of the ongoing difficulties with container shipping, which could cause year-over-year (YoY) declines in performance.

The primary risks include the possibility of slower-than-anticipated global GDP growth or unfavourable disruptions due to geopolitical developments. Changes in trade flows and a reduction in demand for some high-margin or essential products could potentially result from a possible rise in trade protectionism, commonly known as “friend-shoring.”

However, given the current healthy order book, the need to replace an ageing fleet (over 14 years), the need to deal with additional tonne miles that exploded in 2023, the need to reduce speed to comply with intermediate requirements (CII, for example), and the possibility of a new super cycle in the shipbuilding industry to replace all the ships that were delivered in large numbers between 2005 and 2010, shipbuilding activity is likely to show robust performance. This suggests a very similar global figure to last year. According to the business, new building prices rose across all categories in 2023 and are probably going to rise much more in 2024.

According to analysts at ICICI Securities, the margins of MDL have improved in recent times led by ahead-of-time delivery of vessels leading to lower cost being incurred compared to budgeted. The brokerage firm expects high margins to sustain until FY27E as major deliveries are planned over the next 2-3 years. However, once MDL starts executing new orders, its revenue recognition is likely to be milestone based, and hence, EBITDA margin could taper off to 12-15 per cent.